Read more on this topic in the January 2017 INdiana Connections

enewsletter story published by Inside Indiana Business. The story

features information and comments from Cargo Services Jefferson Clay.

CLICK HERE

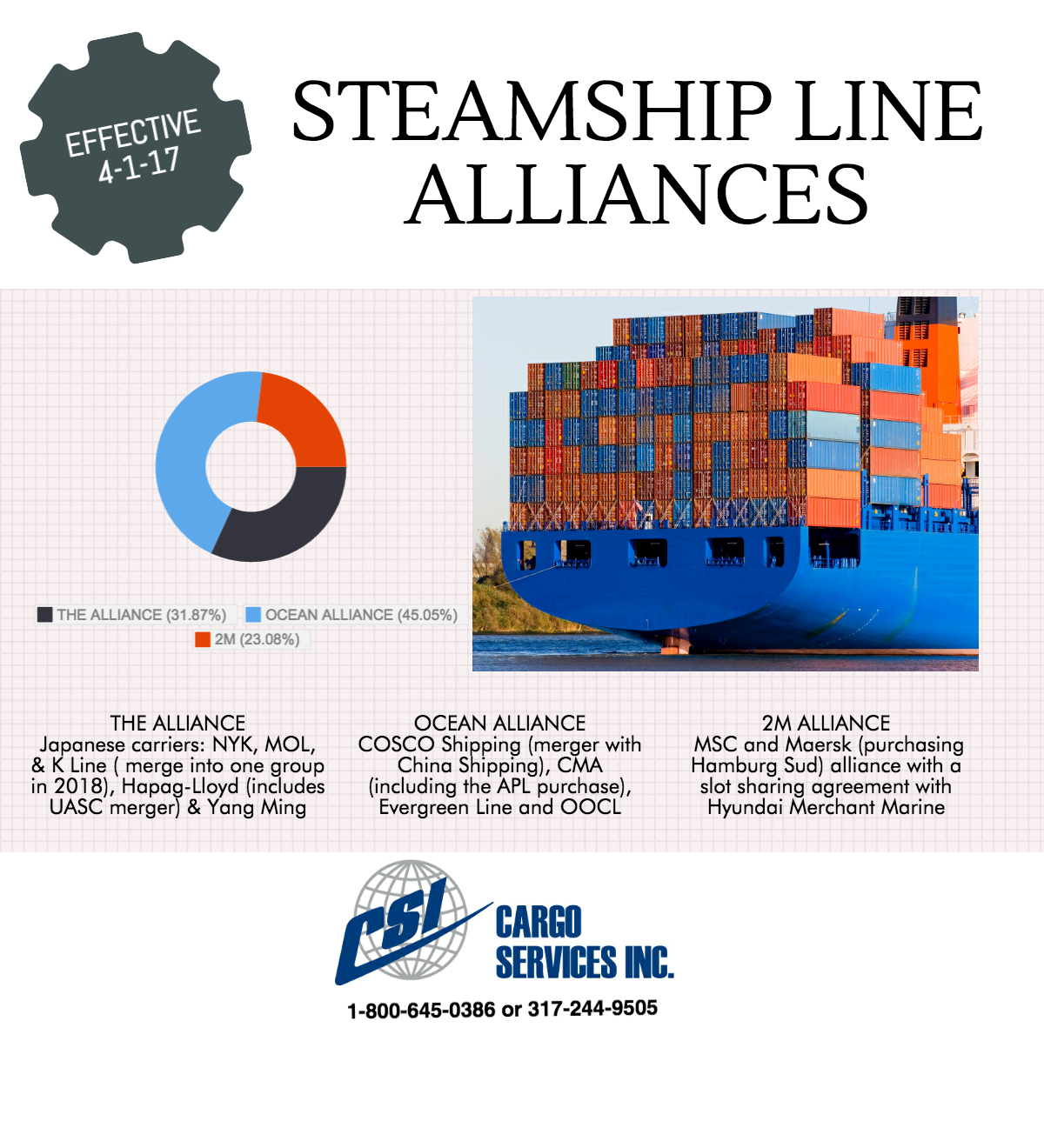

The steamship line industry will form three major alliances beginning April 1. As an international freight forwarder, we are closely watching this industry situation. The new alliances are the carriers’ attempt to continue cost cutting with the aim to move back to the black financially in the next few years. Here are the alliances we’ll be seeing:

Ocean Alliance: COSCO Shipping (merger of COSCO and China Shipping), CMA (including the APL purchase), Evergreen Line and OOCL

THE Allianc

2M Alliance: The already established MSC and Maersk (purchasing Hamburg Sud) alliance with a slot sharing agreement with Hyundai Merchant Marine

For the trans-pacific trade lane between Asia and North America the alliances account for 91 percent of the vessel space, according to Alphaliner.

- Ocean Alliance – 41 percent

- THE Alliance – 29 percent

- 2M = HMM – 21 percent

What does all this mean for the customer?

- This could bring rate volatility if alliances decide to pursue market share. Carriers will continue to place newer and larger vessels in play to drive down per slot costs. The industry will still have excess capacity in 2017, so rates may suffer as carriers try to fill vessels.

- Look for possible delays at U.S. ports caused by larger vessels demanding more resources and space to process ships. Alliances will bring larger ships into service routes from each carrier. Processing these ships at port(s) takes time and could create congestion at the terminals

- Service uncertainty early in the year as carriers workout vessel sharing and service sling(routes) configurations within the alliances

In the long run alliances may stabilize the steamship line industry if carriers develop discipline and are better at sharing resources and information. That will take time in an industry plagued by overcapacity and a history of undisciplined pricing policies.